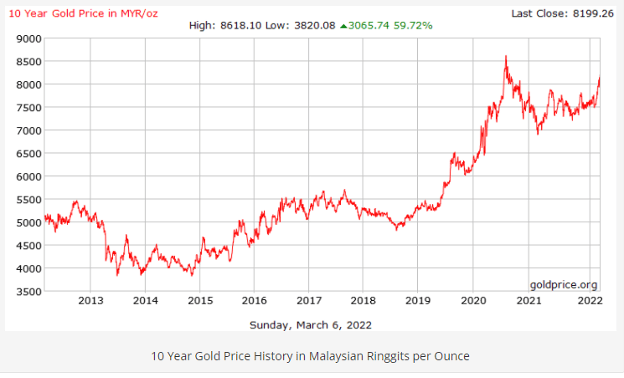

Inflation across the world is at its all-time high. The inflation rate in the year 2021 is around 5% across the world but not in the case of Malaysia which stands at 2.5% compared to 1.25 in the year 2020.While gold has given negative returns in the past 2 years. As of now, gold is trading at 8200 MYR/oz compared to 8600+ MYR/oz in mid of 2020.

Factors to consider before making the decision

If you are in confusion is now a good time to invest in gold in 2022? Here are things you should consider before buying it.

Inflation

Gold has been a symbol of wealth and stability for centuries. It is a good idea to invest in gold if you want to diversify your portfolio and hedge against inflation. Inflation across the world is at its all-time high and can even go further due to the ongoing Russia-Ukraine war. But inflation might not play a major role in gold prices in Malaysia. Even the Malaysian Ringgit can appreciate the sanctions imposed by the EU on Russia for exports. Due to the sanctions imposed Malaysian markets will get greater exposure to international markets. While the extent of the impact will greatly depend on how deeply the conflict goes on. Furthermore, the increase in inflation rates leads to higher card interest rates and ultimately increases the demand for gold.

Geographical Trends

Gold has been a valuable investment asset for centuries. It has historically been a safe-haven asset, but with the global economy in turmoil, it is worth considering the economic factors that affect gold prices. Factors include geopolitical events, inflation rates, and interest rates. For example, the U.S.-China trade war led to a significant drop in the price of gold in early 2019 because investors are concerned about global growth prospects.

Portfolio Diversification

Gold is considered a low-risk asset compared to stocks and mutual funds or index funds. While it also delivers consistent returns ranging between 8 to 10% in past decades. If your portfolio consists of high-risk assets like stocks, cryptocurrency, considering gold to add might not be a bad idea. It will reduce the overall risk. If you already invested in gold well enough in your portfolio increasing stakes might increase your risk associated with it.

Past Performance

Gold is a commodity that has been traditionally seen as an investment of last resort. More specifically, it has been viewed as a refuge for investors who are afraid that the value of their other investments will drop. Gold is considered a good investment because it does not lose its value over time as paper currency does. Gold failed to deliver returns in the past 2 years (as shown in the graph) but has shown its brilliancy in times of financial crisis. (Global Crisis of 2007 and during Corona pandemic)

Should you invest in Gold?

It depends on individual to individual. If you have already invested a major part of your portfolio into low risk or fixed-income assets investing in gold might not be worth it and might reduce the potential returns of your portfolio. While making the decision you should also consider your age and risk appetite of your portfolio and make decisions accordingly.

Conclusion

Investing in gold is one of the ways to diversify your portfolio. Gold prices are not correlated with the stock market and it’s a tangible asset that can be used as collateral for loans. Gold has been the best long-term investment for centuries. It has always outperformed other assets and inflation so it’s a good idea to buy some now. As of now if you want to protect your money from inflation and cannot find other ways to protect you should consider gold to secure it.